Financial Wellness Workshops & Counseling

Community Action Partnership of Hennepin County (CAP-HC) provides workshops and counseling so you can take control of your money and achieve your financial goals.

Financial Wellness Workshops

CAP-HC’s Financial Wellness Workshops cover the basics of managing your money, including budgeting, credit reports, protecting your assets, and more. Workshops are based on the FDIC Money Smart Curriculum and are free and open to the public. Advanced registration is required.

Still have questions? Email us at financialwellness@caphennepin.org or call us at 952-933-9639.

Financial Wellness Counseling

What are your financial goals? CAP-HC can help you accomplish them with free financial wellness counseling. Our certified counselors will review your finances, talk you through your credit report, and help you create a plan to achieve your financial goals.

Financial Wellness Counseling is open to all Hennepin County residents. Submit a request through the form below to schedule a consultation.

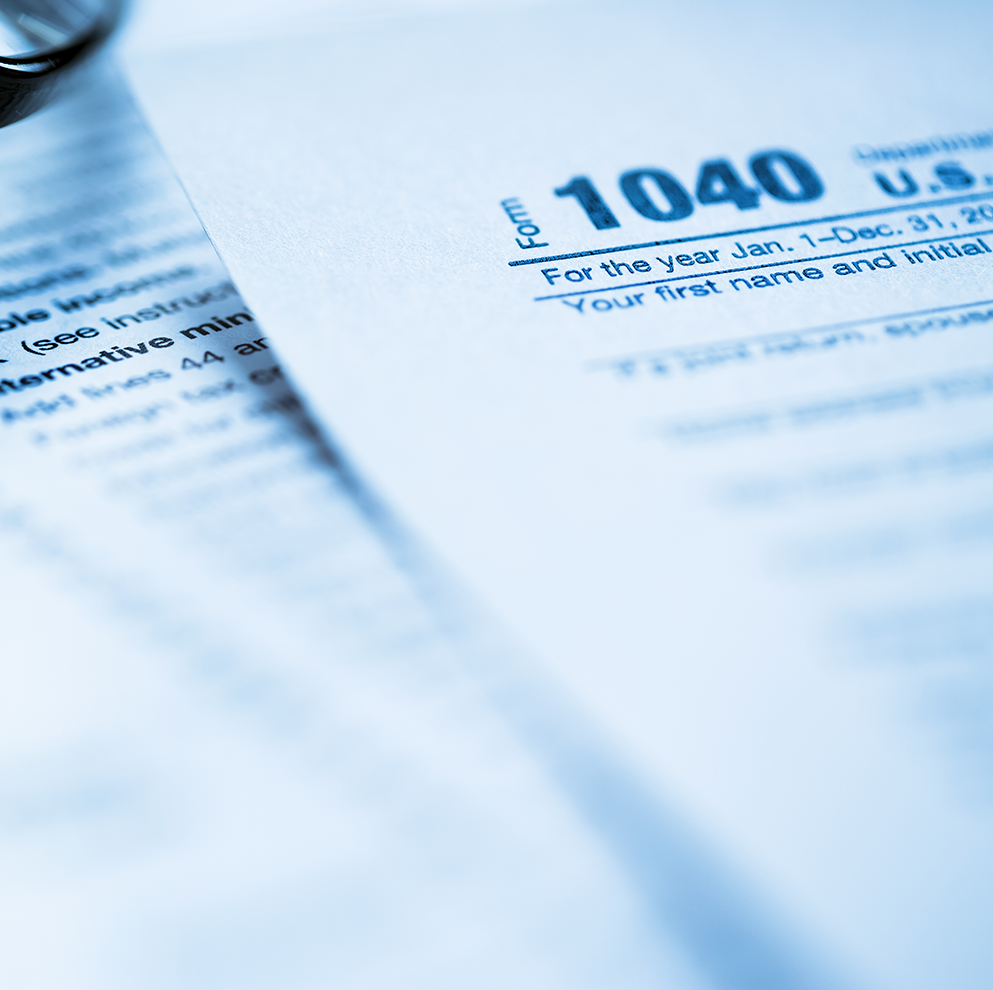

Earned Income Tax Credit

The Earned Income Tax Credit (EITC) helps workers and families with low-to-moderate income get a tax break. If you qualify, you can use the credit to reduce the taxes you owe — and possibly even increase your refund. If you have children, dependents, have a disability, or meet other criteria, you may qualify for more of the EITC.

Visit the IRS website to learn more about EITC, and use the EITC qualification assistant to help you find out if you qualify and to estimate your credit amount.

Request Financial Wellness Counseling

For individuals and families who want to improve their financial well-being, Community Action Partnership of Hennepin County’s Financial Wellness Counseling can help! We offer FREE individual counseling appointments to help you meet your goals of buying a home, increasing your income, decreasing your debt, and building your savings so you can feel more secure in your financial situation today and in the future.

Our certified counselors will:

- Review your finances

- Review your credit (FREE credit report) and help make a credit improvement plan if needed

- Help you identify your goals and make plans to reach them

Schedule your counseling session with a certified counselor today!

Eligibility

Financial Wellness Counseling is open to all Hennepin County residents.

"*" indicates required fields

Upcoming Events

-

Financial Wellness Workshop

Learn More and Register: Financial Wellness WorkshopFREE | IN-PERSON | Using the FDIC Money Smart curriculum, this workshop covers topics such…

-

Financial Wellness Workshop

Learn More and Register: Financial Wellness WorkshopFREE | ONLINE | Using the FDIC Money Smart curriculum, this workshop covers topics such…

-

Financial Wellness Workshop

Learn More and Register: Financial Wellness WorkshopFREE | IN-PERSON | Using the FDIC Money Smart curriculum, this workshop covers topics such…

-

Financial Wellness Workshop

Learn More and Register: Financial Wellness WorkshopFREE | ONLINE | Using the FDIC Money Smart curriculum, this workshop covers topics such…